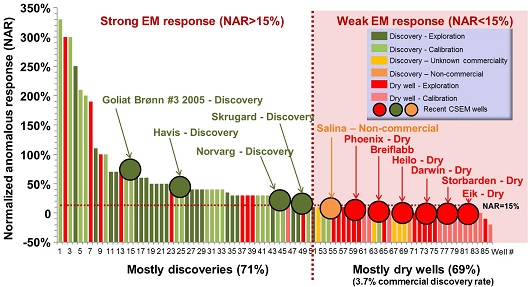

Prior statistics (Hesthammer et al. 2010, Fanavoll et al. 2010) show a clear link between observed normalized anomalous CSEM response and presence of hydrocarbons. Recent wells on the NCS drilled on prospects mapped with CSEM data further supports these observations. Modified after Hesthammer et al., 2012.

Prior statistics (Hesthammer et al. 2010, Fanavoll et al. 2010) show a clear link between observed normalized anomalous CSEM response and presence of hydrocarbons. Recent wells on the NCS drilled on prospects mapped with CSEM data further supports these observations. Modified after Hesthammer et al., 2012.

In the year 2000, the first marine controlled-source electromagnetic survey was conducted over an oil field offshore Angola (Ellingsrud et al., 2002). Over the course of the following thirteen (13) years, more than 750 surveys have been carried out in basins worldwide.

In 2010, on the 10th year anniversary from the introduction of the CSEM two review papers by Hesthammer et al, and Fanavoll et al, published some compelling statistics about the potential value that the technology could bring into the oil and gas exploration industry. However, the uncertainty related to the actual efficiency of the CSEM tool as an exploration tool, remains in debate.

This debate should be expected, since, the number of surveys and companies using the technology are not growing as fast as could have been expected. So, why doesn’t the CSEM service industry grows faster? Should this be considered a positive or a negative sign about the value and the efficiency of the CSEM?

Before answering the question, it is worth noting some facts and observations. On the positive side, super majors like ExxonMobil, Shell and Statoil but also big national oil companies like Petronas, Petrobras and Pemex are among the heavy users of the CSEM for exploration. Although these companies are not always very vocal about their experience all of them have publicly “admitted” the value of the technology.

A second positive observation is that all major discoveries made in the Norwegian sector of the Barents Sea are associated with CSEM positive responses (Fanavoll et al., 2012, Hesthammer et al., 2012). The reason we refer to the Barents Sea is simply because it’s an area from where we have access to relevant information and it has been densely surveyed with CSEM.

On the negative side however, wells are still being drilled over prospects surveyed by CSEM and the failures are more than the successes. Even in the Barents Sea, where there is ample evidence that the CSEM could help de-risk a prospect, there is a significant number of “dry” wells and non-commercial discoveries recently drilled over prospect surveyed by CSEM data (Heilo, Eik, Salina and Darwin).

Do such failures overwhelm the positive evidence and thus leading to the slow adoption of the technology or are there other reasons coming into play? It is naive not to accept the negative impact of the failure cases. However, in the world of geophysics for subsurface exploration, it would also be naive not to expect erroneous interpretations. As a matter of fact, a superficial evaluation of the recent failing wells in the NCS, including the Barents Sea, suggests that all dry wells and non-commercial discoveries have been drilled in places where a relatively weak CSEM response was recorded (figure 1).

Even though this is not necessarily proof that those drill decisions should have been avoided, it is certainly enough to suggest that alternative interpretations should have been considered. A legitimate question to be asked is then “how many decisions to drill wells over prospects with CSEM surveys have been properly weighted in light of the CSEM data?” We are of the opinion that the vast majority of the wells would have been drilled irrelevant of the outcome of the CSEM survey. The reason for this is that the cost/reward relationship for all these wells was positive and we know that oil companies don’t like to leave things behind. Certainly not based on evidence provided by a relatively young technology like the CSEM, for which there is usually very little in-house experience.

Atlantic Petroleum Norge is optimistic that over the years more and more companies will use the CSEM technology not only for de-risking purposes but also for delineation of size and appraisal of discoveries. The pace at which this will happen is dependent on the availability of trained EM geophysicists as well as their integration into the oil companies’ exploration departments.

Almost all NCS areas/basins have one or more identified plays where the CSEM technology can be used to de-risk prospects. Most areas currently open for exploration (APA/numbered rounds) contain CSEM feasible prospectivity. Many EM-friendly plays and prospects have generally not been the focus for traditional E&P companies because they are often associated with higher geological risk than conventional prospects.

Atlantic Petroleum Norge has recently gained access to the EMGS multi-client library for the whole NCS and intends to use these data for screening areas of interest, de-risking prospects and constraining potential HC volumes.